Nobody likes calling customers daily to tell them how much credit card debt they have. While the follow-ups might become redundant, the debt is likely to be sent to debt recovery agencies for credit card debt collection to ensure

effective debt recovery solutions in case no recoveries are made through internal efforts.

With inflation and economic fluctuations on an upward trajectory, it can be difficult for customers to keep up with their expenses, and they may need to use credit services in case of financial shortcomings. And that’s the best part about the process, but only if they clear the unpaid invoices on time.

The downside of not doing so can have severe implications on your company’s cash flow due to higher operational costs and the potential for bad debt. Many companies may collaborate with a credit card debt collection agency to mitigate risks and ensure streamlined collections while fostering positive customer relations.

What is Credit Card Debt?

Credit card companies allow customers to make purchases and transactions depending on their credit limit. The company then writes these transactions off as credit card debt.Users are not obligated to clear their invoices with a single payment but are encouraged to pay in smaller amounts monthly.

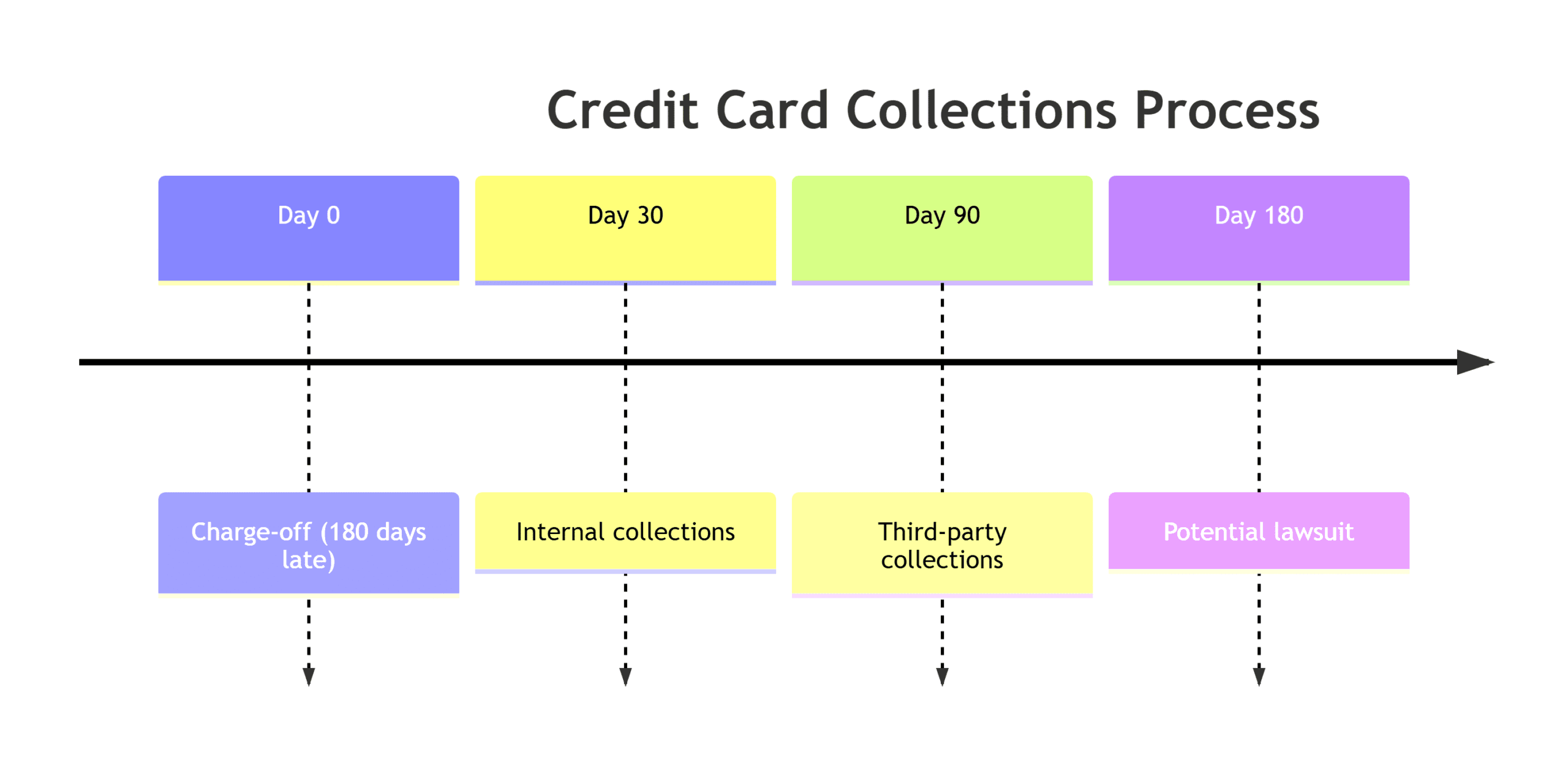

These payments, in turn, will continue accumulating if the customer does not promptly keep up with their unpaid invoices, known as credit card debt.At the start of the credit card debt collection process, the credit company uses its resources to reach out to its customers as payment reminders to clear their debt.

If these efforts work to no avail, the company will be forced to involve a third-party collection agency to maximize recovery potential with credit collection services. According to sources from InDebted, the global buy now pay later market is projected to reach an estimated $90.51 billion by 2029, which increases the likelihood of credit card companies collaborating with a credit card debt collection agency.

Why Should You Be Worried in Credit Card Debt Collection?

With customers not clearing their unpaid invoices, credit card debt collection can become increasingly difficult as more resources will be invested for potential returns. Such allocation of resources without an effective credit card debt collection process can lead to companies facing substantial financial losses, which can also cause:

- Cashflow Disruption: The company’s cashflow will take a more significant hit as more resources are expended to collect debt in credit card debt collection, which has the risk of leading to bad debt.

- High Default Risk: When customers consistently fail to clear their debts, the default risk becomes substantially higher throughout the credit card debt collection process.

- Lost Interest Fee : Investopedia reports that credit card debt has some of the highest interest rates across the industry.

- Capital Instability: When evaluating strategies to boost collections in bad debt, the company will have difficulty figuring out efficient ways to retain capital if customers do not comply with credit card debt collection.

Steps Involved in Credit Card Debt Collection

Credit cards have quickly become a norm recently, with Forbes ADVISOR stating that around 82% of Americans own at least one credit card. With credit card debt seemingly increasing annually, more and more companies are moving credit card debt toward collections. Here are the steps in the debt collection process for better transparency and effective credit card debt collection.

Follow-ups

In the beginning phases of credit card debt collection, the company utilizes its internal resources to reach customers. Such follow-ups can be processed through company calls, emails, portal notifications, and more.

Grace Periods

Whether the customer complies with the follow-ups or not, the company allows a grace period to enable the users to clear their invoices after the due dates without any additional charges or interest fees to facilitate them in credit card debt collection better.

Debt Notices

Once the grace period ends, the company is bound to send a final debt letter to the customer, which includes the total amount owed by them along with the subsequent consequences in case of failure to clear the debts.

Case Assessment

A crucial step in credit card debt collection is deciding whether to continue recovery efforts or contact the credit card collection agency once the final debt notice has been sent. Such decisions are made based on a thorough evaluation and assessment of the situation to determine the best action plan.

Collaboration With Third Party Collection Agency

When all internal efforts result in no recoveries, the credit card debt collection is either sold or transferred to a collection agency to proceed with the case.

Initial Communication

The recovery agency sends an initial notification to the customer informing them that their credit card debt has been transferred to the respective collection agency, and they are now responsible for moving forward.

Negotiations and Settlement

The collection agency continues communicating with the customer through debt recovery negotiations so that a settlement can be made that requires the customer to either pay the full or a partial amount owned in credit card debt collection. Such debt validation ensures that some debt can be collected in the credit card debt collection process.

Credit Bureau

The last resort for the credit card debt collection agency is to report the customer’s debt to the credit bureau, which in turn negatively impacts the credit score and creditworthiness. However, sources from Chase report that customers can improve their credit score by paying off a large sum of the debt owed; not paying the credit debt on time can still have long-term effects.

Litigation Support

Recovery agencies can also decide to take legal action, which may involve court proceedings, legal councils, lawsuits, and trials.

Can Credit Card Debt Affect Your Credit Score?

In short, yes, credit card debt can impact your credit score. Unpaid debt is written as charge-offs on your credit report, which remains a record for the upcoming seven years. Any debt sent to the recovery agency for credit card debt collection is also added to the credit report separately.

All such factors can make it difficult for customers to get their credit approved in the future and face challenges in applying for loans.

Furthermore, customers with lower credit scores also have higher interest rates, emphasizing the importance of effective credit card debt collection.

What Are the Regulations in Credit Card Debt Collection

With reports from LendingTree suggesting that Americans alone have a credit card debt of $1.115 trillion as of 2024, the respective authorities have enforced the to effectively deal with credit card debt collection while fostering positive relations with customers; authorized entities have placed regulations and laws surrounding the recovery process, which ensures fair recovery practices across all channels.

Fair Credit Reporting Act (FCRA)

The FCRA is a federal law focusing on the authenticity and reliability of the consumer’s credit information. According to the regulation, credit card debts are to stay on the credit report for up to seven years, while records of bankruptcies have a longer tenure of ten years.

Credit Card Accountability Responsibility and Disclosure Act (CARD Act)

The CARD Act enforces clear information on interest rates, contractual terms, and deduction fees for transparent credit card debt collection operations to ensure customers do not pay excessively.

The regulation also requires credit card companies to make monthly credit statements that showcase the time it’ll take for the customer to clear the debt in case of minimal installment payments.

Fair Debt Collection Practices Act (FDCPA)

The FDCPA focuses on credit card debt collectors’ practices to ensure that customers are not harassed or threatened and to enhance customer relations to improve recoveries.

How Can CollectCo Help with Your Credit Card Debt Collection

As the premier debt collection platform, CollectCo ensures effective debt negotiation and custom-tailored solutions for customers and credit companies in credit card debt collection. With a wide range of proven AR strategies, our digitized platform has maximized collections for thousands of users worldwide. At CollectCo, we prioritize our customers and mitigate the risk of bad debt.